In recent years, many business publications have sought to put an accurate value on an MBA education by calculating the actual financial return on investment (ROI). It’s true that post-MBA salaries are the highest they have ever been. But does that guarantee a positive ROI for MBA graduates? How should prospective applicants consider evaluating the ROI of their education? Let’s dive into the details.

What Does it Cost?

Based on several years of data, the average total cost to attend a top-25 U.S. MBA program today is $210,724, with no less than 15 of those programs already topping $200,000 in total cost. Stanford is the most expensive at an estimated $244,000, while UT-Austin ranks 25th at a cost of about $160,000. In terms of tuition alone for U.S. programs, Wharton tops the chart at $84,874 in 2022, and every school on Poets & Quants’ top-26 has a tuition of at least $53,000. Meanwhile, the strength of the dollar against the Euro (close to 1:1 at the time of writing) makes some top European MBAs feel more affordable than usual compared with top-25 U.S. programs. HEC Paris, for example, one of the most expensive European B-Schools, currently costs €158,000 over two years.

On top of tuition, cost of living significantly adds to the investment involved in obtaining an MBA. But cost of living varies greatly from programs located in cities like New York or Paris compared with programs in the Midwest or mid-sized European cities. When calculating financial aid packages, Stanford includes a living allowance of $36,198 for single students and $60,084 for married students, while other sources speculate that living costs for a two-year MBA at Stanford, NYU, and UCLA exceeds $100,000. According to Poets & Quants, the average annual cost of living among the top-26 U.S. B-schools is $26,331, with the most affordable school on the list being Indiana Kelley ($15,456).

Electing to pursue a full-time MBA also involves a tradeoff of two years of professional earnings, growth, and potential promotions, commonly referred to as opportunity cost. Investopedia offers the following simple formula for calculating opportunity cost:

Opportunity cost will necessarily come with caveats for each individual, as someone hoping to accelerate their career while staying in or around the same field will experience a very different opportunity tradeoff from someone whose primary goal of studying an MBA is to pivot to a completely different role.

Earnings Are Up

In response to critiques of the high cost of getting an MBA, head hunters, business publications, and universities themselves commonly estimate that acquiring an MBA has the potential to increase a candidate’s salary by 100%, and in some cases as much as 140%. Career reports from MBA programs each year generally support these claims. Nearly every top-25 U.S. MBA program boasts about record earnings statistics for its graduates year-in and year-out – consider these recent reports from the University of Virginia and Georgia Tech. MBA graduates themselves are slightly less bullish, with a 2021 GMAC survey showing that 79% of respondents felt that graduate management education increased their earning power.

In addition to salaries, it is increasingly common for hiring companies to offer competitive signing bonuses to MBA grads to help offset some of the debt from their MBA and/or to mitigate some salary costs. In a 2018 survey of more than 1,000 companies by GMAC, 56% of companies in the US, 36% in Asia-Pacific, 30% in Latin America, and 20% in Europe said they would offer new B-School hires signing bonuses.

Earnings Vary by Function

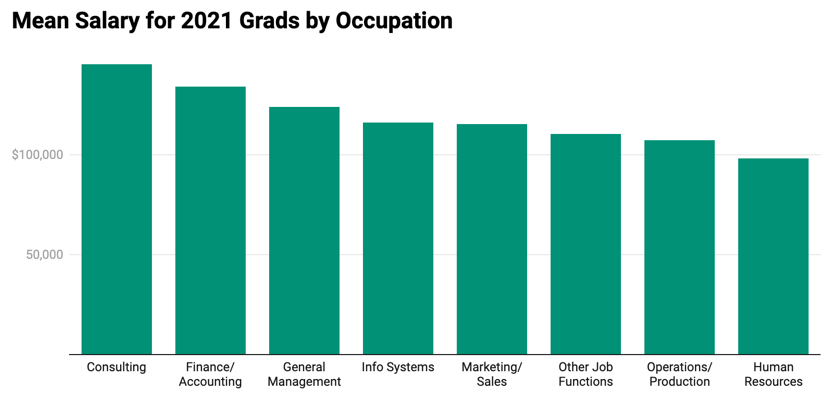

While professionals generally report significant salary increases across all industries, consulting, finance, and general management have traditionally outpaced other occupations in terms of post-MBA compensation. According to U.S. News, “The weighted average base salary for MBA grads in 2021 who became consultants was about $145,000, while it was nearly $134,000 among those who became accountants or financiers and about $124,000 for general managers.” The table below, from the same report, shows seven functions that were reported to offer starting salaries above $100,000, with Human Resources also nearly reaching that mark. Candidates considering their move to a new function following their MBA should get familiar with the employment reports from their target schools, which can help applicants understand which programs show strong alignment with the functions and industries that are most relevant to their career plans.

Hiring Outlook

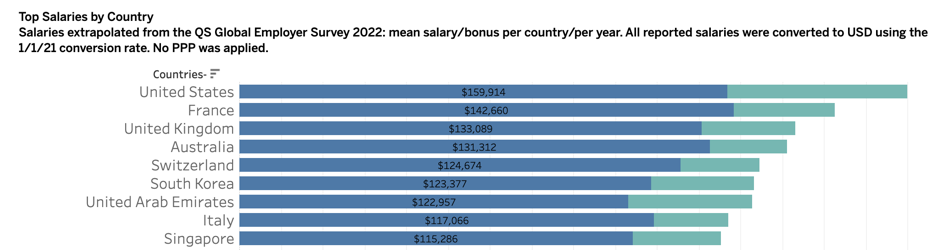

If you have read this far, it should come as no surprise that hiring outlooks are right in line with rising salaries across industries and functions, according to the QS Employer Survey Report 2022, which surveyed nearly 5,100 employers around the globe. At the time of the survey, employers in several major economies reported that they expect MBA hiring levels to increase over 2020 and 2021 levels, including the U.S., where 70% of employers expected an increase in MBA hiring numbers, China (60%), Singapore (57%), India (54%), France (50%), and the U.K. (50%).

[Conclusion]

While all of these sources and statistics help shape to our understanding of the potential ROI of an MBA, one essential source that we’ve yet to consider is MBA graduates themselves. The GMAC whitepaper “The Value of Graduate Management Education: From the Candidate’s Perspective,” a study that followed 3,600 people from their first consideration through graduation, reports that 90% of graduates rate the value of their MBA or master’s as good, outstanding, or excellent. Two-thirds of those surveyed said they advanced at least one job level after obtaining a graduate business degree and three out of four agreed that their degree helped them achieve their personal, professional, and financial goals. One does not have to look far to find several other statistics and testimonials to back up these numbers from business publications and business schools. So, the perception that an MBA is financially worth it in terms of ROI appears to be widely agreed upon and supported by both financial statistics and MBA graduate opinions. Should you decide that it’s time to pursue an MBA of your own, contact us today for a FREE 20-minute consultation to discuss your questions about how an MBA can help you, pivoting your career direction, programs that you are considering and much more.